Bitcoin’s Journey: From Cypherpunk Dream to Global Asset Bitcoin’s journey is a fascinating tale of cryptographic innovation, ideological fervor, and market volatility. It began in 2008 with the publication of a whitepaper by Satoshi Nakamoto, a pseudonymous individual or group, outlining a “peer-to-peer electronic cash system.” This paper proposed a decentralized digital currency free from government or financial institution control, aiming to solve the “double-spending” problem without relying on a trusted third party. The initial years were characterized by niche adoption, primarily within cypherpunk communities fascinated by the concept of digital scarcity and decentralized finance. Early adopters, often technically proficient, mined Bitcoin using their personal computers and exchanged it on small, largely unregulated platforms. The first real-world transaction occurred in 2010 when Laszlo Hanyecz famously traded 10,000 Bitcoins for two pizzas, a purchase now worth hundreds of millions of dollars. As Bitcoin gained traction, it attracted both enthusiasts and skeptics. The price fluctuated wildly, reflecting its nascent status and vulnerability to market manipulation. Early challenges included security breaches at exchanges like Mt. Gox, which led to significant losses and temporarily dented Bitcoin’s reputation. Despite these setbacks, Bitcoin’s underlying technology continued to evolve, and its community grew. Alternative cryptocurrencies, known as altcoins, began to emerge, inspired by Bitcoin’s success and aiming to improve upon its design. This burgeoning crypto ecosystem brought further attention and innovation to the blockchain technology underpinning Bitcoin. Around 2013, Bitcoin began to gain mainstream attention. Its price soared, attracting media coverage and piquing the interest of investors beyond the initial cypherpunk circles. This period also saw increased regulatory scrutiny as governments worldwide grappled with how to classify and regulate Bitcoin. Some embraced it as a disruptive innovation, while others viewed it with suspicion, citing concerns about money laundering and illicit activities. The late 2010s witnessed institutional interest in Bitcoin, with hedge funds and other large investors exploring its potential as an alternative asset. The introduction of Bitcoin futures contracts on established exchanges provided a degree of legitimacy and attracted further institutional capital. Major companies, like MicroStrategy and Tesla, began adding Bitcoin to their balance sheets, further validating its status as a store of value. Bitcoin’s journey hasn’t been without its bumps. Price crashes have been frequent and often dramatic, reminding investors of the inherent risks associated with this volatile asset. Regulatory uncertainty remains a constant challenge, with governments worldwide adopting diverse approaches. Despite these challenges, Bitcoin has demonstrated remarkable resilience. It has evolved from a fringe experiment into a globally recognized asset, sparking innovation in finance and technology. While its future remains uncertain, Bitcoin’s impact on the world is undeniable, and its journey is far from over. It continues to evolve, facing both opportunities and threats as it navigates the complex landscape of finance and technology.

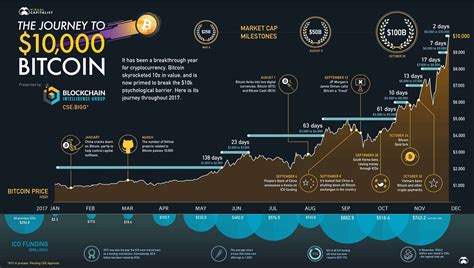

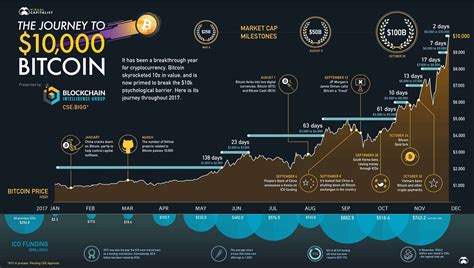

3018×1710 fascinating bitcoin journey daily infographic from www.dailyinfographic.com

3018×1710 fascinating bitcoin journey daily infographic from www.dailyinfographic.com

300×300 journey bitcoin infographic grandpa bitcoin from grandpabitcoin.com

300×300 journey bitcoin infographic grandpa bitcoin from grandpabitcoin.com

2400×1256 bitcoin journey blockchain council from www.blockchain-council.org

2400×1256 bitcoin journey blockchain council from www.blockchain-council.org

1600×1536 visualizing bitcoins wild ride decade from howmuch.net

1600×1536 visualizing bitcoins wild ride decade from howmuch.net

1920×1080 bitcoin journey dergigicom from dergigi.com

1920×1080 bitcoin journey dergigicom from dergigi.com